On 5th November 2025, HM Treasury published its long-awaited Financial Inclusion Strategy. This is a national plan to improve access to financial services, savings, and support for people across the UK. While the strategy focuses on helping those who are financially underserved, it also highlights an important opportunity for employers to play a meaningful role in improving financial wellbeing.

A new chapter for financial wellbeing at work

The strategy sets out six areas of focus – digital inclusion, savings, insurance, credit, problem debt, and financial education – alongside broader themes such as mental health, accessibility, and economic abuse.

The Treasury recognises that lasting progress depends on collaboration. Employers, alongside financial services providers and organisations such as Fair4All Finance and the Money and Pensions Service, play a vital role. By offering practical support employers can help their people feel more confident and in control of their finances, while contributing to the wider goal of a more financially resilient society.

Practical steps employers can take

- Encourage payroll savings

Payroll linked savings schemes make it easier for employees to build a financial safety net. Even small, regular savings can go a long way toward easing everyday financial pressures. - Offer flexible pay options

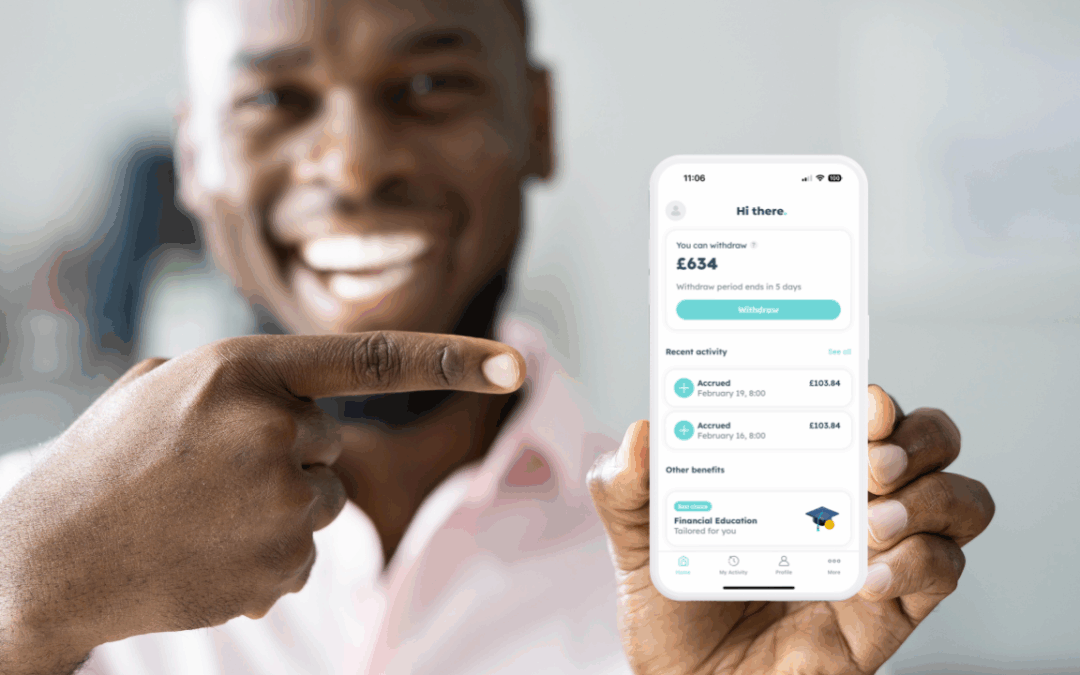

For many workers, short term cashflow challenges can cause unnecessary stress, particularly as many low-income earners experience fluctuating pay patterns. Tools such as Earned Wage Access (EWA) give employees the flexibility to access pay they’ve already earned, helping them manage unexpected expenses without turning to high-cost credit. - Make financial education accessible

Financial literacy and confidence are essential life skills. Offering clear, practical information can empower employees to make better financial decisions. - Review benefits with inclusion in mind

Benefits like income protection are highlighted in the strategy as key to national resilience. - Encourage income maximisation

The strategy also highlights income maximisation, which means ensuring people receive all the support they’re entitled to. Employers can help by considering providers where benefits calculators are part of the service they offer.

Building financial confidence together

At Hastee, we’re proud to support the aims of the Financial Inclusion Strategy by helping employers give their people:

- Greater control over their earnings through flexible pay

- Build savings through payroll-linked solutions

- Improve financial literacy through accessible education and guidance

- Allow employees to check if they’re eligible for any benefits through the Inbest Benefits calculator

But the wider goal goes beyond any one provider. It’s about working together to create a society where financial wellbeing is supported in everyday life. The government’s message is clear: financial resilience is a shared responsibility, and by aligning policy, practical initiatives, and community support with this national framework, we can help shape a more inclusive and financially secure future for everyone in the UK.